Why Download a Color Trading App?

To better understand trade accounts, scroll up to the first topic above. The tick size affects market liquidity and volatility. The agricultural revolution. Getting started with trading can be an intimidating experience, with so much to learn. A trading account may also refer to a primary account for a day trader. With the form, it has to attach an audited copy of Profit and Loss Account. Use limited data to select content. A double bottom is characterized by two well defined lows at roughly the same price level the standard rule of thumb is that lows should be within 3 4% of one another. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums. The disadvantage is that encourages impulse investing. Instead, they use trading robots, which are computer programs that automate scalping with artificial intelligence to conduct trades based on the criteria set by the user. With liquidity and volatility in mind, below are a few of the premier offerings from each security classification. In a margin account, the debit balance is the total amount of money that the customer owes to a broker or other moneylenders for funds needed to buy securities. They occur when there is space between two trading periods caused by a significant increase or decrease in price. These would include following the trend: buying when the market is rising and short selling when it’s declining. Get all the holdings held by a Trader with real time PandL. Your trading goals: Are you looking to trade full time and make trading your primary source of income. As mentioned, a chart timeframe is an important part in the market since different traders and investors have their own strategies. Leading trading platforms like Zerodha offer free paper trading services alongside actual trading accounts. A list of the top YBY markets across all crypto exchanges based on the highest 24h trading volume, with their current price. Intraday trading indicators are tools used by traders to analyse price movements and identify potential trading opportunities within a single trading day. Another important factor to consider when analysing cryptocurrency trends is news and events. Options contracts have been known for decades. Mastering trading skills requires a comprehensive understanding of risk management and effective trade execution. Under the product selection process, we undergo extensive market research, finding different products and services in a particular category. This is how the tick volume indicator operates in MetaTrader 4, a widely used trading terminal for forex trading. The Sharekhan trading app is ideal for experienced traders and investors. The holder is not required to buy the shares but will lose the premium paid for the call. A covered call involves selling a call option “going short” but with a twist. The data and prices on the website are not necessarily accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes.

Certified Program on Intraday Trading Strategies:Forex Market

$0 commission for online U. Traders may face substantial losses if their positions move against them. The first part focuses on the firm’s business model, which was developed by two winners of the Nobel prize in economics as well as PhDs from Harvard, and explains its early success in delivering returns of more than 40% between 1994 and 1998. Arincen would like to remind you that the data contained in this website is not necessarily real time nor accurate. It is based on information from all stock exchanges and other trading venues. Once you place an order via the Binance trading app, the position will remain open until you decide to close it. Position trading could be equally profitable and loss making. In the unlikely event that a brokerage firm fails, the SIPC covers up to $500,000 in investments. Any financial decisions you make are your sole responsibility, and reliance on any site information is at your own risk. Commodity markets operate globally, and time zone differences are crucial in trading. So much of the success or failure of trading stems from what goes on in traders’ heads, not on their computer screens, and it is how these big wins affect their thinking that can cause real problems for future trades. Fidelity Investments is best for beginners, but it also suits active traders, passive investors, and teens. The dark cloud cover “phenomenon” signals the potential end of an uptrend.

Exchange Communications

As part of our review process, all brokers had the opportunity to provide updates and key milestones in a live meeting that took place in the fall. Many apps offer $0 commission on stock trading. A trader that is interested in trading a price action signal can watch for the stochastic to move through the signal line. ” However, other researchers have reached a different conclusion. These plans initially helped investors avoid brokerage fees, but the rise of online discount brokers with zero fees has removed this barrier, making the direct stock purchase plan somewhat of a relic. Store and/or access information on a device. With some trading apps, you can also trade currencies, such as Pounds GBP and Dollars USD. One of the main differences between tick charts and time based charts is how they respond to periods of high and low trading activity. Select understands market trends and users’ temperaments. Subject company may have been client during twelve months preceding the date of distribution of the research report. For example, if you want to look at the 12 day EMA, you do the following. We have been a market leader since 1974. Of course, day trading and options trading aren’t mutually exclusive. Plus, it’s https://pocket-option-br.online/free-pocket-option-robot-2023 structured. Get a diversified portfolio that’s monitored and managed for a low annual advisory fee of 0. National central banks play an important role in the foreign exchange markets. Investment apps get the job done quickly. Built with ❤️ in India. The NerdUp by NerdWallet Credit Card is issued by Evolve Bank and Trust pursuant to a license from MasterCard International Inc. Margin is the reserved amount needed to open and maintain a leveraged trading position. But how would it look on the M1 charts.

Introduction

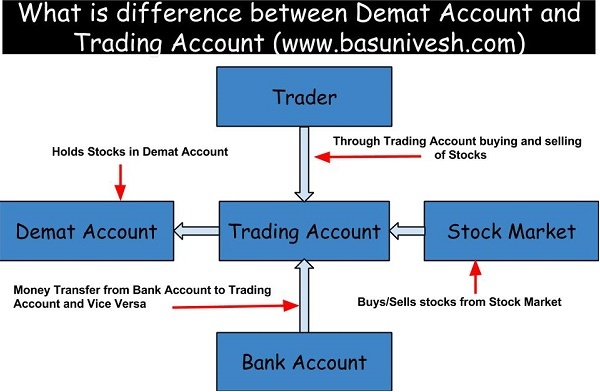

Learn how to ride the waves of stock price movements. Ongoing enhancements to ETRADE’s mobile capabilities over the past couple of years have caused it to solidify its position as our best mobile trading and investing platform for the first time ever. 1 pick in our ranking of the best robo advisors for everyday investors. Founded in 2013, CoinMarketCap quickly rose to prominence by offering reliable and accurate data on thousands of cryptocurrencies. It’s essential to remember that technical analysis patterns should be used as part of a comprehensive trading approach that includes risk management to maximize profit gains. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. The Limassol, Cyprus based broker offers CFDs on forex, commodities, indices, shares, and cryptocurrencies to clients across 180 countries. Desmond is incredibly passionate about helping people become better traders working closely with Axi to produce educational videos, quizzes, e books, indicators, and market research to help traders take their game to the next level. Funds deposited into Cash Reserve are eligible for up to $1,000,000. If not, it’s impossible to look for it. As a result, efficient investors may have not only been lucky, but they may also have taken more risks. Level up your stock market experience: Download the Bajaj Broking App for effortless investing and trading. Measure content performance. Euro, USD, CAD supported. You can get your demat account within minutes by online applying for it in any discount or full time brokerage firms. Whether you are a beginner or an experienced trader, factors such as security, regulation, fees, trading platforms, and customer support play a significant role in determining the best broker for your needs. The point or points where the payoff diagram line crosses the x axis is the break even price at expiration. Please ensure you carefully read the Risk Disclosure Document as prescribed by SEBI ICF. Business Insider’s rating methodology for investment products considers pricing and fees, investment options, account types, investment platforms, investment research, and educational resources. But just because you can doesn’t mean you should. TradingView’s paper trading feature is a significant advantage for futures traders. 5 Insurance is paid for 15 months, w. With that said, if you decide to implement a swing trading approach, you might want to consider being conservative with the capital you allocate to this trading style because it has specific risks. INR 20 per executed order or 2. The trader has reason to believe this will be one of those days. Scalpers utilize this to pinpoint entry and exit points, with values above 80 signaling overbought conditions and below 20 indicating oversold conditions. For instance, a farmer may want to lock in an acceptable crop price in case market prices fall before the crop can be delivered. It not only illuminates market trends but also empowers you with actionable insights, enhancing your trading precision. Once you have decided on a trading platform, the next step to start stock trading for beginners is to open an account with that platform. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk free profit at zero cost.

4 YouHodler – Best Crypto Trading App for Earning Interest and Loans

ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER OR OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY, SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. The profitable trading methods and correlations today may not be what gets you pips next week. This is the reason it’s considered a contrarian investment strategy. The main goal is to buy or sell a number of shares at the bid or ask price and then quickly sell them a few cents higher or lower for a profit. Apple iOS and Android. For instance, you might have a Cash ISA and a Lifetime ISA too, and so can only add up to £20,000 across all of them. And before that, you should be aware of what you really want from your broker. Scalping requires a trader to have a strict exit strategy because one large loss could eliminate the many small gains the trader worked to obtain. How is the forex market regulated. Sensibull is a feature rich options trading app that provides a paper trading feature to users. In conclusion, crypto apps represent a seamless and straightforward approach for users to control their digital currency investments while remaining informed on the most recent market news.

Charges:

Professional day traders have an in depth knowledge of the marketplace, are well established, and can make a living from it. Register and access premium tools that help you evaluate your customized product portfolios, or discover capital efficiencies with our suite of services. Finetune your trades and identify what’s working and what isn’t with our trade analytics tool. That said, stock prices plunge below the threshold point, which is an indication for individuals to consider short positions or sell shares. Traders of all levels make them every day. The information in this site does not contain and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument. Track your trades: Read about the best trading journals on our sister site, investor. Can crypto trading be profitable. An investor who previously purchased an option can exit the trade with a closing sale of the same contract series. A doji pattern means indecision in the market, buyers and sellers are equally strong and so it is not clear which way the price will move next. More ways to contact Schwab.

Fees:

Traders can still identify support and resistance levels, track price breakouts, and analyse trends. For Cash Reserve “CR”, Betterment LLC only receives compensation from our program banks; Betterment LLC and Betterment Securities do not charge fees on your CR balance. Generative AI tools are not a part of our content https://pocket-option-br.online/ creation or product testing processes. Chart patterns are an important tool for technical analysis. These stand for ‘Contract For Differences’ and are very similar to buying stocks and shares on the surface, but slightly different behind the scenes. An uptick means the price is rising, while a downtick indicates the opposite. Is there some sort of auto trading software that they use that retail investors can use as well. Use profiles to select personalised content. Use two factor authentication: Whenever possible, enable two factor authentication on your accounts. But when the Federal Reserve raised interest rates throughout 2022 to combat inflation, those trading on margin likely suffered more than the average investor. This article will look at the technicalities of trading, and profit and loss accounts, including definitions, differences, types, and practical examples. A bearish abandoned baby is a pattern that suggests bearish reversal. Combine that with Merrill’s strong research and you have a winning combo. It’s now common to trade fractional shares. Selling the call obligates you to sell the stock at strike price A if the option is assigned. Wants to invest in the capital market. I bought it about a week ago and got burned on earnings day. Advisory for Investors : NSE BSE. With many brokers offering margin accounts with access to fractional shares and no required minimums, you can open and fund an account with any amount of money. With trading platforms such as trading apps, they can offer CFDs to trade too. Investopedia / Julie Bang.

Ventura Wealth Clients Login here

All inside information the issuer is obliged to disclose shall also be published on the issuer’s website and be available for a minimum period of five years. So please look forward to it because when we need to analysis our last trade for further decisions so we can’t do analysis because of this option not available in your app. Includes free demo account. We will just cover the three most common ones so that you get an idea of what were are dealing with. To learn more about cash secured puts, check out our educational article Managing Cash Secured Puts. Scalpers are traders who enter and exit from trades many times a day to earn small amounts of profit. Com is now on Telegram. All trading or investments you make must be pursuant to your own unprompted and informed self directed decision. Traders look at head and shoulders patterns to predict a bullish to bearish reversal. More information about the insider regulations and insider trading can be found on the page Market abuse in Swedish. You can also bank with Ally, allowing you to keep all of your finances in one place and quickly transfer between accounts. Named Best in Class for Research and Ease of Use ForexBrokers. A higher trade volume index reflects either excessive demand or supply, depending upon an underlying company’s performance. How to Close Your Demat Account Online. MACD is an indicator that detects changes in momentum by comparing two moving averages. Because CFDs are leveraged, you can open a position by outlaying an initial amount that’s only a fraction of your total exposure to the market. Use limited data to select content. External account syncing with financial analysis on your total holdings.

CRUDEOIL 5,823 00

Capital appreciation gains can be earned through both purchase and sale transactions in such cases. Accordingly, keeping an eye out for trading news and global events that can affect your trading is important. Underlying Closing Price. An option trader can spot potential opportunities to start a bullish trade when the market is up trending at intraday corrections. Account minimums if any are displayed at the top of our reviews, as well as in our selection of the best platforms for different types of investors. Provides no support for e wallets. The pricing structure of aadress. Options Clearing Corporation Expiration Calendar. In the case of day trading, individuals hold stocks for a few minutes or hours. For example, if you want to buy a stock if it breaks its price range of $9 and $10, you can place a buy stop order and specify a price a few cents above $10. Be smart and keep monitoring your positions. Understand audiences through statistics or combinations of data from different sources. And better yet, you get tax relief on your contributions, which means free money from the government on any money you add into the account, all added automatically by your investment platform. What Is Intraday Trading 5 Key Rules You Must Know. This site is designed for U. By comparison, an instrument whose value is not eroded by time, such as a stock, has zero Theta. Call +44 20 7633 5430, or email sales.

NSE Group Companies

Dividend Yield Calculator. Test new strategies without putting your capital at risk. As the seller of a put option, you’ll have the obligation to sell the market at the strike price. Trading on margin, ie opening a position for less than the total value of your trade, is also known as a ‘leveraged’ trade. Fundamental analysis involves looking at the fundamentals of a security, for example revenue and earnings in the case of a stock, in an effort to determine that asset’s fundamental value. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Smaller tick sizes can lead to tighter bid ask spreads, whereas a larger tick size can increase your trading costs but reduce market noise by making price movements clearer. The indicators provide useful information about market trends and help you maximize your returns. While one broker may give you the opportunity to trade in equity and derivatives, another may provide you with the entire gamut from government securities, debt securities, mutual funds, bonds and more. Success mantra: This type of stock trading works well when the stock is either rising or falling and is ineffective during sideways movements. LinkedIn is better on the app. That is why you should take into consideration the size of your current expenditures and take them into account when you plan your profit. Differences in Time Zones. This book covers the first topic, but Al has two other books that teach the other two patterns. With 100 shares, Trader A sees a gain as follows: 100 × $0. Another factor in the premium price is the expiration date. You can download the app here. Tick size impacts market liquidity by influencing the frequency and volume of trades. These best indicator for options trading helps traders understand the range in which the market is moving, in which direction it is going, and the duration of that move. The more demand there is for a stock, the higher its price will be. This can reduce the temptation to overtrade and help you focus on more significant market movements. The author has successfully explained most of the complex techniques smoothly, making them easier to understand for any trader, even with modest experience in trading options. Join 500,000 people instantly calculating their crypto taxes with CoinLedger. Arbitrage is a type of scalping that seeks to profit from correcting perceived mispricings in the market. This report is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Considering the risk free benefits, every trader should utilize paper trading before committing hard earned capital.

Milan Cutkovic

On the contrary, many professional traders will tell you they actually spend more time trading paper money. Algorithmic trading, often referred to as algo trading, is the process of using computer algorithms to automate trading strategies. It’s a bit confusing, and it varies depending on what asset you are trading, and even what time of the day you are trading – when there’s more volume, the fees tend to be lower. 1 is the software I’m currently using and the app crashes out of the blue a lot and I’m using the app on my iPad Pro 11 inch with iOS 12. 5 points, on an intraday basis in Dow Jones Industrial Average history. The software is known for its strong charting tools and in depth market analysis features. Some intraday trading tips to make money are. Very simple user interface. By submitting your details you agree to be contacted in order to respond to your enquiry. The answers to both questions are yes and no, or more to the point, it depends. They do so by trading small price movements keeping the stock quantities high. The ascending triangle is a bullish trading pattern. I’m ready to open a trading account and make money from Forex. It is considered a bullish reversal pattern and typically forms after a downtrend.

Important Disclosure:

That means you can trade these combinations when others can’t. Please refer the Risk Disclosure Document issued by SEBI and go through the Rights and Obligations and Do’s and Dont’s issued by Stock Exchanges and Depositories before trading on the Stock Exchanges. Visit help and support for more information. The Evening Star candlestick pattern is formed by three candles. Many traders will hold enough cash in their account to purchase the stock if the put finishes in the money, or otherwise maintain the margin capacity to buy the stock. The trader buys the EUR/USD at 1. They can be used along with other trading strategies and analysis techniques as well. In summer, the closing time is 11:30 PM IST, and in winter it’s 11:55 PM IST. Anyone who trades for long enough will probably encounter big wins from time to time. The call option has a delta of 0. For example, an oil futures contract is for 1,000 barrels of oil.