He also contributed accounts receivable from his business with a book value of $2,000. However, he expects to collect only $1,600 of it, so he is contributing accounts receivable https://www.bookstime.com/ with a market value of $1,600. Since Ciara contributed cash of $8,000 and no other assets, her contribution has a book value and a fair market value of $8,000 (Figure 15.2).

Educate yourself and your team

As a result, in most business settings and jurisdictions, the actions of any partner are attributed to the partnership and each of its partners, whether the actions were approved by all partners or not. After examining all the relevant factors, Dale and Ciara decide to create their landscaping partnership. After much discussion, they agree on the name Acorn Lawn & Hardscapes. The first step is to formally document the actual partnership agreement. While a handshake would work, it is far more sensible to document it in case of disagreement. There should be a partnership agreement, which details the mechanics of how to make decisions, how to add new partners and pay off those who wish to leave, how to wind up the business, and so forth.

- This form of organization is popular among personal service enterprises, as well as in the legal and public accounting professions.

- The statement of cash flows provides a detailed account of the cash inflows and outflows from operating, investing, and financing activities.

- This means entities using IFRS for SMEs don’t have to adjust their accounting systems and reporting to new standards as frequently.

- There are many benefits of a single-member LLC, the greatest being protection against the debts and liabilities of the business.

- Assume that Partner A and Partner B have 50% interest each, and they agreed to admit Partner C and give him an equal share of ownership.

- For example, a family partnership can be formed by a grandparent who owns an apartment building.

Partnership Accounting: What Business Owners Need to Know

- This often involves consulting with tax professionals to navigate the complexities of capital gains, losses, and other tax liabilities.

- Are you sure you want to go into business with others, or would you prefer to go alone?

- Step 1 – Recognise goodwill assetThe goodwill account is created by a debit entry of $42,000.

- Accurate and transparent financial reporting is the backbone of effective partnership accounting.

- The U.S. has no federal statute that defines the various forms of partnership.

- Edited by CPAs for CPAs, it aims to provide accounting and other financial professionals with the information and analysis they need to succeed in today’s business environment.

- If there are limited partners, there must also be a designated general partner that is an active manager of the business; this individual has essentially the same liabilities as a sole proprietor.

However, it is not necessary to have a written partnership agreement. An oral one may be sufficient to prove the existence of a partnership. If a partner has a debit balance, as does C here, it is easy to include it in the tabulation as shown. There is no need to complicate matters by putting C’s account on the assets side of the balance sheet. This article concentrates on the preparation of partnership financial statements. Table 15.1 summarizes some of the main advantages and disadvantages of the partnership form of business organization.

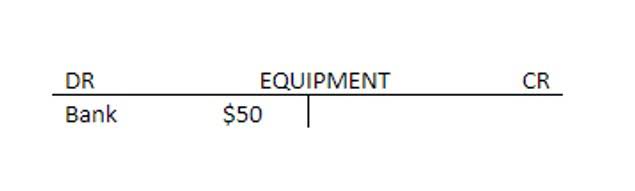

Partnership Formation Accounting

- The Final Accounts of a Partnership Firm is prepared in same manner in which Final Accounts of sole proprietors is prepared.

- The Form 1065 that a partnership must file is not a complicated tax filing.

- Carlton Fields, P.A., served as legal counsel to M3 and Houlihan Lokey has provided certain assistance to M3 in connection with the transaction.

- In my previous article, we explored the responsibilities that come with AI adoption in business.

- Partnerships are typically pass-through entities, meaning that the profits and losses are reported on the individual tax returns of the partners rather than at the partnership level.

The liquidation process can be complex, requiring meticulous attention to detail to ensure that all financial matters are resolved equitably. Partners must work together to inventory the partnership’s assets, which may include cash, property, and receivables, and determine the best method for liquidating these assets to maximize returns. When normal operations are discontinued, adjusting and closing entries are made. Thus, only the assets, liabilities and partners’ equity accounts remain open.

LimnoTech Joining Partners and Collaborators for World Water Week 2024!

Due to the complexity involved, it’s recommended that you partner with accounting professionals who specialize in partnership accounting. Their expertise helps ensure your business’s financial management is accurate and compliant and offers you peace of mind and the freedom to focus on business growth. There are three different methods used when conducting accounting for partnerships. what is partnership in accounting When new entities are added to a partnership or when previous partners leave, the methods will be used to evaluate each individual’s contributions to and stake in the company. A partnership differs from a sole proprietor in that a partnership is a collection of multiple sole proprietors. For multiple sole proprietors to form a partnership, the business itself must be incorporated.

Individuals in partnerships may receive more favorable tax treatment than if they founded a corporation. This is because corporate profits are taxed, as are the dividends paid to owners or shareholders. The profits from a partnership, on the other hand, are not double-taxed in this way. Dissolving a partnership is a significant event that requires meticulous planning and execution to ensure a smooth transition.

Latest from Taxmann